will capital gains tax change in 2021 uk

The proposed capital gains tax reforms of which any Budget. 14600 at 20 2920.

Capital Gains Tax For Individuals Not Resident In The Uk Low Incomes Tax Reform Group

Because the combined amount of 20300 is less than 37700 the basic rate band for the 2021 to 2022 tax year you pay Capital Gains Tax at 10.

. Driving the news. CGT raises close to 10bn a year for the Treasury and last year the chancellor commissioned the Office of Tax Simplification OTS to look at how this tax could be reformed. President Biden today will unveil a 2 trillion infrastructure plan that the White House hopes to pay for via changes to the corporate tax code.

Capital Gains Tax UK changes are coming. Reduce the Capital Gains Tax-free allowance. In December 2020 the Wealth Tax Commission presented their report on proposed changes to the current tax laws.

Many speculate that he will increase the rates of capital gains tax to help raise cash necessary to recoup the public costs arising as a result of the COVID-19 pandemic. Currently there are four rates of CGT between 10 and 28. Chancellor Rishi Sunak laid out changes to capital gains tax CGT as part of his 2021 Budget delivered on October 27.

UK Tax Change 2021. The biggest question asked of private client advisors over the past couple of years is when do we expect Capital Gains Tax CGT to increase. Will capital gains tax rate change in 2021 Sunday May 8 2022 Edit.

With that established lets take a look at the potential changes in Capital. The Chancellor will announce the next Budget on 3 March 2021. 36000 at 40 14400.

Here is everything you need to know. If you own a property with a partner you both get that personal capital gains tax allowance. Capital Gains Tax changes that Self Assessment customers need to know.

The OTS review of CGT. But observers believe that other taxes and reliefs will be at the forefront of new revenue raising plans in the next budget or further down the line. Once again no change to CGT rates was announced which actually came as no surprise.

Despite record levels of MA activity in the build-up to the Budget with Azets advising on 50 deals in just ten weeks no announcement was made and CGT reform. The first band is utilized first. The second part of the report is due in 2021.

October 29 2021. It comes amid ongoing silence from the Treasury around rumoured changes to Capital Gains Tax CGT which had been expected to feature in the Chancellors Spring Budget 2021 on 3 rd March. The rest of your income is charged in the basic rate band since the remainder is lower than 32370.

For investment property Capital Gains Tax rates are slightly different basic-rate taxpayers pay 18 with higher-rate taxpayers paying 28. Figures from the Treasury released in August show that its Capital Gains Tax receipts hit 98billion in the 201920 tax year up four. Changes to UK CGT are likely to be an attractive option to the Chancellor as he looks at ways.

One of the areas the government is looking to increase its tax collection from is capital gains. Will things likely change in 2021. So for the first 12300 of capital gain you could take that money completely tax-free.

Any gain over that amount is taxed at what appears to be particularly favourable rates with basic rate taxpayers paying tax at 10 or 18 on residential property and high or higher rate taxpayers only incurring tax at 20 28 on your gains from. These changes may be significant and have large ramifications for your investments. The remaining 14600 is used to charge you capital gains of the same amount within the basic band.

Presidents dont normally get two swings at major tax reform which is why. A recent report from the UK Office of Tax Simplification OTS following a review of the Capital Gains Tax CGT has outlined some recommended changes to Capital Gains Tax. It is thought that income tax rates will be raised to 45 and it is likely the capital gains tax rate will increase to match it.

Although it is now clear Capital Gains Tax CGT and Inheritance Tax IHT rates and allowances have avoided changes in 2021 they are still very possible for the budget in 2022 or in future years. Capital Gains Tax UK changes are coming. There S A Growing Interest In Wealth Taxes On The Super Rich Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes Capital Gains Tax 101.

The Biggest Shake Up In Capital Gains Tax Ever. In other words the first 24600 of profit you can get tax-free. You only pay Capital Gains Tax on gains above your annual tax-free allowance which is currently 12300 in 202021.

HMRC customers have until 31 January 2021 to declare any profit made from selling a UK residential property which was not. Plus a change to the capital gains rules with a midyear effective date eg a 20 top capital gains rate for pre-April 2021 sales and a 396 top capital gains rate for sales. The Capital Gains Tax annual exemption is 12300 for the year 20212022.

Implications for business owners. Each year at the moment there is a personal capital gains tax allowance. Alongside maintaining the Lifetime Allowance and Capital Gains Tax it is estimated the Treasury will raise some 204billion.

Many speculate that he will increase the rates of capital gains tax to help raise. Tax due 17320. It comes amid ongoing silence from the Treasury around rumoured changes to Capital Gains Tax CGT which had been expected to feature in the Chancellors Spring Budget 2021 on 3 rd March.

But it will not include any changes to individual income taxes including on capital gains. Budget capital gains tax CGT. The capital gains tax-free allowance for the 2021-22 tax year is 12300 the same as it was in 2020-21.

The Chancellor could decide to reduce this allowance with these changes being tapered over a number of years. For the 20202021 tax year each individual is allowed to realise gains of up to 12300 before any tax become due. Reduce the current Capital Gains Tax uplift on inherited assets.

Entrepreneurs relief was slashed last April so that instead of being charged 10 on the first 10m of gains anything above 1m would be taxed at the usual 20. For 2021-22 youll be charged at 10 on the first 1m of gains when selling a qualifying business the same as the 2020-21 tax year. The capital gains tax-free allowance for the 2021-22 tax year is 12300 the same as it was.

Simple Ways To Avoid Capital Gains Tax On Shares The Motley Fool Uk

Capital Gains Tax On Gifts Low Incomes Tax Reform Group

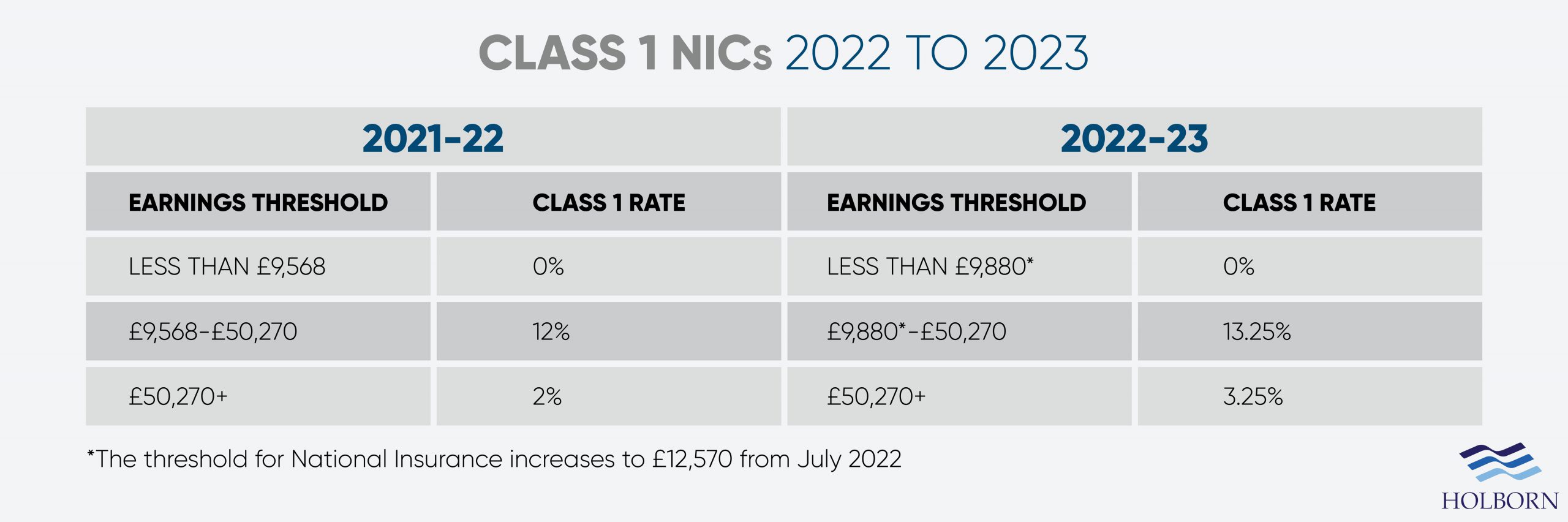

Changes To Uk Tax In 2022 Holborn Assets

Comparison Of Uk And Usa Take Home The Salary Calculator

How To Reduce Your Capital Gains Tax Bill Vanguard Uk Investor

The Future Of Tax Legal Embracing Change With Confidence Accounting Accounting Course Financial Accounting

Accotax Accountants In 2021 Accounting Accounting Services London

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

A Limited Company Or Limited Liability Partnership What Type Of Company Is Better In The Uk Call Accountants Uk Limited Liability Partnership Personal Financial Management Legal Business

What Kind Of Business Insurance Do You Require Call Accountants Uk Business Insurance Business Insurance

Changes To Uk Tax In 2022 Holborn Assets

Uk Tax Explained For Investors Traders Investing Investors Explained

11 Easy End Of Year Tax Tips To Increase Your Tax Refund Tax2win Blog Tax Refund Happy New Year Blog

What Are Capital Gains Tax Rates In Uk Taxscouts

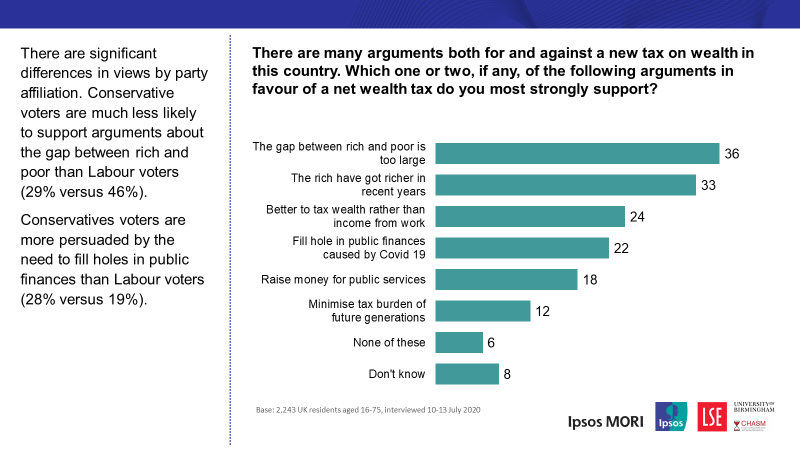

Britons Support Paying More Tax To Fund Public Services Most Popular Being A New Net Wealth Tax Ipsos

British Consumers Started The Big Splurge Real Time Data Show In 2021 Online Jobs Job Website Job Posting

Tax Accounting Services For Landlords And Property Owners In 2021 Accounting Services Being A Landlord Tax Services

What Are The Best Places In The Uk To Invest In Property The Property Talk Rwinvest In 2021 Investment Property Investing Best Way To Invest